Empowering Your Financial Future with Confidence

At M.C. Byrd Wealth Management, we partner with you to help you achieve your unique financial goals through comprehensive wealth management solutions.

Empowering Your Financial Future with Confidence

At M.C. Byrd Wealth Management, we partner with you to help you achieve your unique financial goals through comprehensive wealth management solutions.

Staying Ahead of the Curve: Financial Trends and Strategies

Achieve Your Goals

We help you define your financial goals, create a plan to achieve them, and make informed investment decisions along the way.

Personalized Strategies

We take the time to understand your unique needs, risk tolerance, and investment preferences, and create a financial plan that is tailored to your specific situation.

Seasoned Guidance

Our experienced wealth advisors provide ongoing support and guidance to help you navigate financial decisions with confidence.

Cutting-Edge Technology

We leverage advanced tools and resources to ensure your financial plan remains up-to-date and aligned with your evolving needs.

A Partnership for Your Financial Success:

Don't Miss Out on Our Exclusive Resources

- Gain Valuable Financial Insights: Attend our informative webinars to learn about a variety of financial topics, from retirement planning to investment strategies.

- Hear from Knowledgeable Industry Figures: Learn from financial professionals and gain insights from their experience.

- Enhance Your Financial Knowledge: Expand your financial knowledge and stay up-to-date on the latest trends and strategies.

Embark on a Personalized Wealth Management Journey

At M.C. Byrd Wealth Management, we understand that every financial journey is unique. That’s why we take a personalized approach to building long-lasting relationships with our clients. Our process is designed to help you achieve your financial goals with confidence and peace of mind.

Initial Consultation

Our journey begins with an initial consultation, where we'll get to know you, your financial goals, and your risk tolerance. We'll delve into your current financial situation, investment preferences, and any concerns you may have.

Comprehensive Financial Planning

Armed with a deeper understanding of your needs, we'll craft a personalized financial plan tailored specifically to you. This plan will outline a roadmap to achieving your goals, considering your investment horizon, risk tolerance, and overall financial well-being.

Ongoing Communication and Guidance

Your relationship with MC Byrd Wealth Management doesn't end with the creation of your financial plan. We'll maintain regular communication with you, providing ongoing guidance and support as your financial situation and goals evolve. We'll review your plan periodically to ensure it remains aligned with your changing needs and market conditions.

A Wealth of Financial Knowledge at Your Fingertips

In addition to personalized wealth management services, we also offer a wealth of general financial knowledge through our regular blog posts. Our blog provides timely updates on market trends, insightful retirement strategies, and commentary. Whether you’re a seasoned investor or just starting to learn about personal finance, we believe our blog will equip you with the knowledge you need to make informed financial decisions.

If Recession Materializes, What Might It Mean For Stocks?

For those reading the business press, 2025 has had no shortage of headlines. Swings in the stock and bond market in April equalled some of the most extreme events of the last 40 years. In its desire to reorganize global trade, the administration has warned of short-term pain for long-term gain. In line with that assessment, Wall Street economists have increased their recession probabilities. Alternative asset manager Apollo recently published a chartbook we recommend viewing at this link. They forecast

Can A Reduction In Government Spending Impact GDP?

With the first quarter coming to a close, we can definitively say that it has been an eventful start to the year. Headlines of tariff wars, government spending cuts, and defense pullbacks have dominated market action. Given the novelty of these policies and the degree to which they are being negotiated and/or challenged in courts, it is difficult to assess how they might impact markets and the economy. That said, we find it interesting and useful to pay attention to

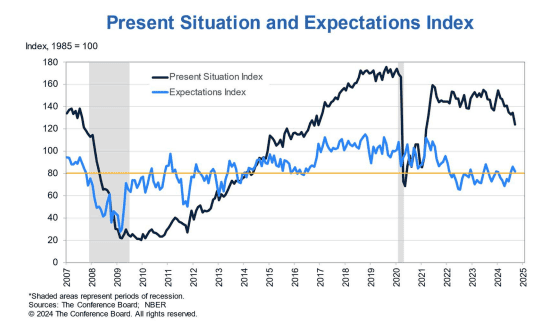

What Consumer Confidence Tells Us About Unemployment & The S&P 500

After the blistering August heat, the cool(er) winds of fall are always welcome. This year the economy appears to be cooling off at the same time. Last week, we received the latest update to the Consumer Confidence Index. This Conference Board survey asks consumers key questions about their financial health. Many surveys have lost their predictive ability due to political polarization. Because this survey asks about consumers’ personal situations, it remains an accurate guide to the economy. The broad index