January 2015 started out with such high hopes for a lot of forecasters. Top forecasters projected that the S&P 500 index would end somewhere between 2100 to 2350 by December 2015. However the S&P 500 ended in the red for the first time since 2011 down .73 percent closing at 2043.94. The Russell 3000 index which represents the broad market ended down 1.47 percent for 2015.

The relative flatness of the market doesn’t really tell the whole story.

The American market can really be divided into two parts… growth and value. The Russell 3000 Growth index was up 5.09 percent including dividends while the Russell 3000 Value index was down 4.13 percent including dividends.

While this points to a split in the market the narrowness of the market is a real concern. This can be illustrated through the FANG stocks. FANG is an acronym for Facebook, Amazon, Netflix and Google. In a November 13 MarketWatch article, FANG accounted for 98.7 percent of the markets return at the time of the writing. In other words 2015, can be described as a very narrow market. Narrow markets tend to be a sign that a bull market is coming to a close. It also can lead to a dangerous portfolio allocation as people tend to chase returns.

2015 was a tremendously rough year in commodities as well. This in turn caused emerging markets to stumble badly. The CRB Commodity Index was down roughly 24 percent. The MSCI Emerging Market Index was down approximately 15 percent.

Fixed income was also a struggle. Especially in sectors like high yield. The S&P High Yield Corporate Bond Index was down 3.99 for the year.

In other words the only winner was Growth. Mainly large growth. Of course, a long term investor would not want 100 percent exposure to one sector of the market especially at what seems to be the end of a bull run.

My Disappointing Trade for 2015

Every money manager can look back over their career and point to disappointing trades. They should be memorable and few. I remember the 1994 bond market. I had a disappointing trade. This year I had a disappointing trade in master limited partnerships that are composed of pipeline companies. The reason for this trade was high income based on real assets. They have a history of not being tied to the equity market and a low correlation to the commodity market. This was not the case this year. We still believe in the trade but it did get caught up in the commodity market slide. The average investor does not understand how pipelines work and we believe time will correct this. At the time of this writing, you are starting to see some recovery. Patience is the best course of action because the income is good while we wait for the market to recovery especially since the projected income surpasses the projected return of the S&P 500 for 2016.

The Importance of Asset Allocation and Dividends

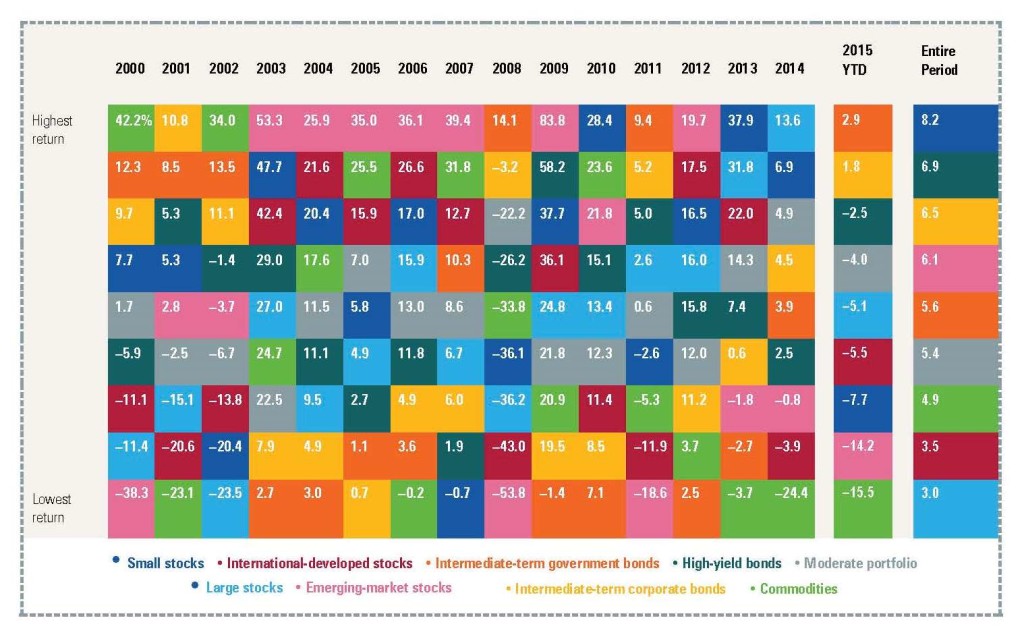

Asset allocation funds had their worst year since 1937 according to a recent Bloomberg article. However, we are still a believer in asset allocation for the long term. Asset allocation is built upon the premise that you should have exposure to multiple asset classes. Just as I mentioned earlier about forecasters missing the 2015 S&P 500 level, it is impossible to accurately time the markets. Asset allocation with active rebalancing serves investors well over the long term. Below you will find an Asset Class Winner and Loser Chart through the end of the 3rd quarter of 2015. The moderate portfolio is in gray. While the moderate portfolio has a losing year through the 3rd Quarter, you can see that you typically stay within the middle of the pack without the volatility over time.

Source: Small stocks—Morningstar Small Cap Index. Large stocks—Morningstar Large Cap Index. Int’l stocks—Morningstar Developed Mkts ex-U.S. Index. Emerging stocks—Morningstar Emerging Mkts Index. Interm. govt bonds—Morningstar Interm. U.S. Govt Bond Index. Interm. corp. bonds—Morningstar Interm. Corp. Bond Index. High-yield bonds—Barclays U.S. High Yield Corp. Bond Index. Commodities—Morningstar Long-Only Commodity Index. Moderate portfolio—Morningstar Moderate Target Risk Index. © 2015 Morningstar.

Dividends play a vital role in your portfolio especially if you are taking an income from your portfolio. You have heard the old adage “Don’t eat your seed corn”. This is true with investing. Dividends should make up a large portion of the check that you receive. If not you are having a return of principal, your seed corn. I would rather experience market volatility than cannibalize my portfolio. In our growth with income portfolios, we are currently running a high dividend portfolio. This has led to some volatility but it reduces the exposure to principal withdrawals. If we are entering into a prolonged low growth environment dividends will become more important because it will be difficult to have your check come primarily through capital growth or stock appreciation. The real risk here is outliving your money not market volatility.

We have dividends pay to cash in all portfolios before making a decision to invest.

2016 Outlook

The American market is expensive by most measures and the bull market is getting old. The current PE ratio for the S&P is around 22 while the median is in the mid 14s. The Schiller PE Ratio or Cape is in the top ten percent of its historic average. Corporate profits are flat. In addition the party supplied by the Federal Reserve is starting to wind down. These metrics started flashing expensive in the Fall of 14. We are extremely cautious in the American Market.

The emerging markets are cheap at this point. You don’t want a lot of emerging markets but they do make sense in the portfolio. In addition, while the Federal Reserve is winding down our party of monetary stimulus, the rest of the world is continuing their party for a while longer. Foreign developed markets look attractive because of this and valuation metrics. We also are attracted to alternative investments such as long short funds, managed futures and arbitrage funds which are designed to limit portfolio risk and have a low correlation to the overall market.

As mentioned earlier, dividends and cash flow are an important component of the portfolio especially for the retirees portfolios that we manage. Dividend investors were punished in 2015 but this is not the norm. A longer term perspective is needed.

I would also like to take this time to make a comment about market volatility. During the last six years we have had a market that has been historically stable. This is not the norm. Be prepared for normal volatility to return to the capital markets. Volatility can be our friend.

We will continue to monitor markets and make decisions based upon value, risk and income.

I have listed below articles that will support my overall views for your reading.

http://www.businessinsider.com/wall-street-2015-sp-500-forecasts-2015-1

http://www.marketwatch.com/story/this-market-has-fangs-but-not-much-else-2015-11-13

http://online.wsj.com/mdc/public/page/2_3023-monthly_gblstkidx.html

Let me close by thanking you for your continued trust in our firm. We always strive to do the best for our clients.

Happy New Year,

Monte C. Byrd

Investment advisory services offered through M.C. Byrd Wealth Management

We are licensed to sell insurance products in the following states: Louisiana (LA), Texas (TX)