The Eagles were right. Life in the fast lane will make you lose your mind. However, most people don’t realize it until it is too late. This may be the case for people who have made investments on margin.

If you aren’t familiar with margin investing, it is basically borrowing money from your broker to purchase stock. This leverages your investment. Leverage will magnify your gain or loss.

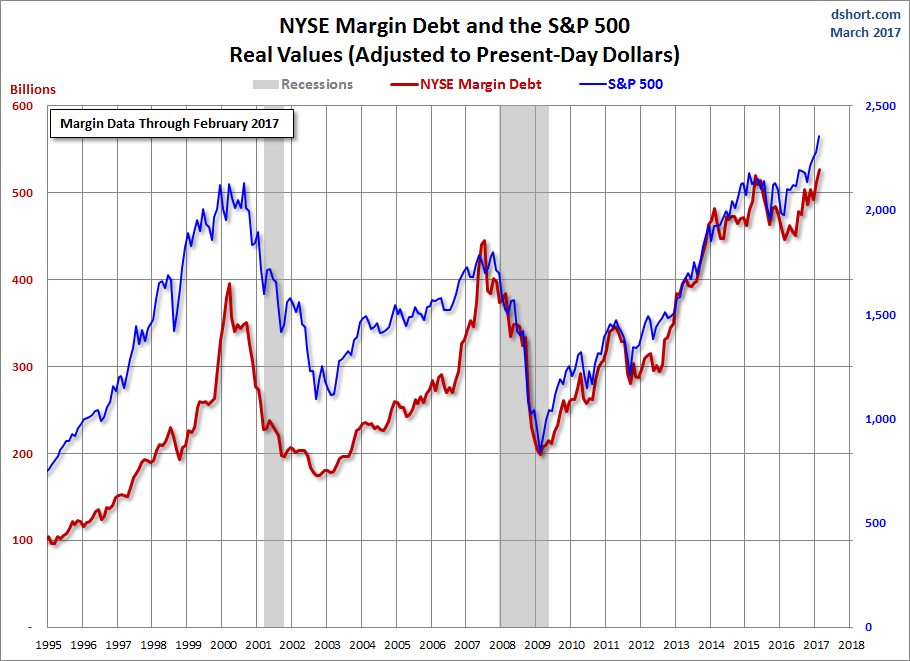

Our friends at DShort have two great charts on margin debt. The first chart shows margin debt’s correlation with the S&P 500.

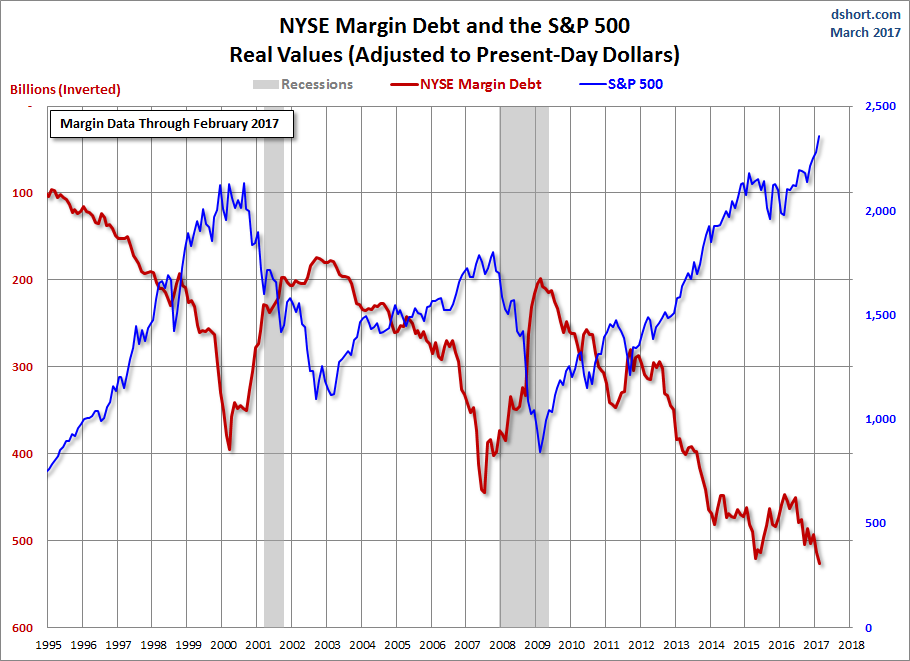

You will notice that margin debt is currently at an all-time high, along with the S&P. The next chart is the same information with margin debt inverted to show the relationship between the two.

As you notice on the chart, peak margin debt was correlated to the market peaks of 2000 and 2007. I believe, we now find ourselves in a similar chart pattern with margin debt at an all-time high.

One could argue that margin is an indicator of overconfidence in the market.

How might this effect an investor who does not invest with margin? The answer is supply and demand. When you invest with margin, you get a margin call when the value of your securities drop. This means that you have two choices. You can deposit more funds in your account to cover the shortfall or you can sell your securities. When more sellers come to the market than buyers, prices adjust downwards to absorb the excess supply. Your shares are valued at the price of the most recent transaction.

This is just another reason why investors should be cautious in this environment. In past blogs we have covered other reasons as well. We are currently in the second longest bull run in market history. Valuations such as PE ratios are historically high. The Federal Reserve is intent on monetary normalization. And this is without mentioning geopolitical uncertainty.

Staying out of the fast lane is a prudent move at this time.