In a recent New York Times article, Ruchir Sharma quoted George Goodman’s comments regarding the stock market bubble of 1967:

Those who leave early are saved, but the ball is so splendid no one wants to leave while there is still time. So everybody keeps asking — what time is it? But none of the clocks have hands.

This hit home recently when, in response to a question of when the next recession might occur, a commentator insinuated that we have ceased participation in a normal business cycle. While intended as an excuse for obscene valuations it points to the many who have forgotten about market risk.

Recessions and expansions are inherent to market based economies. From 1850 through the present the U.S. has experienced at least one recession every decade.

The three longest expansions have taken place within my lifetime. Our current expansion is the third longest, and if it continues through May of 2018 it will be the second longest.

Partygoers looking at the clock without hands is a vivid reminder that no one knows when the cycle will end. But we do know the aftermath is painful.

The chart below illustrates the aftermath of the 1960’s rally. The market, represented by the S&P 500, basically went nowhere until 1980.

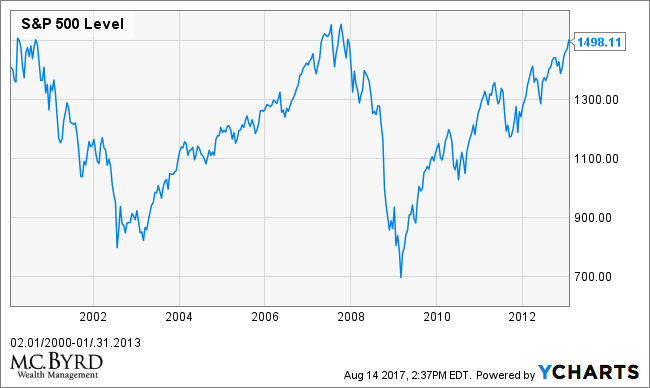

That chart is eerily similar to the aftermath of the tech bust shown below:

While the clock might lack hands, one can have a sense of when to leave. Reducing risk is a prudent strategy at this time. To quote Willie Nelson: “All good things must come to an end.”