If you were a Johnny Carson fan you might recall his skit “Carnac the Magnificent”, in which a turbaned Johnny Carson delivered humorous predictions of the future. Just watching Carson wear the hat made you laugh. Perhaps we should have a lighter attitude towards people who claim that they can predict the market with certainty. It really is a very difficult business.

Larry Kudlow, the newly appointed White House economic advisor, provides an excellent example prior to the collapse of the housing bubble. In a November 24, 2008 Baltimore Sun article titled, “The Worst Economic/Financial Predictions of 2008” Larry Kudlow makes the list for his December 2007 prediction:

“There ain’t no recession. Today’s ADP private jobs survey of 189,000 could produce a 200,000 non-farm payroll job gain for November. I don’t know — these wacky BLS numbers are subject to huge revisions. But the ADP was a huge number. In fact, jobs seem to be picking up major steam from their August low, rising in September and October. And now I’m expecting a good increase in November to be reported by the BLS this Friday.”

Shortly after these comments were made, we found ourselves in the worst economic contraction since the Great Depression.

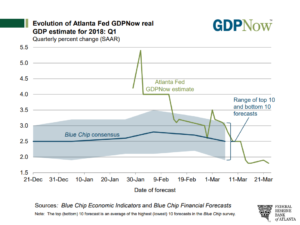

These foibles aren’t limited to celebrity economists. Central bankers also illustrate the difficulty in hitting forecast targets. On February 1st of this year, the Atlanta Federal Reserve estimated first quarter GDP growth at an annualized rate of 4.0%.

On February 16th, they lowered their forecast to 3.2% on an annualized basis, only to be followed by a 2.6% growth forecast. As of March 16th, we are at 1.8%.

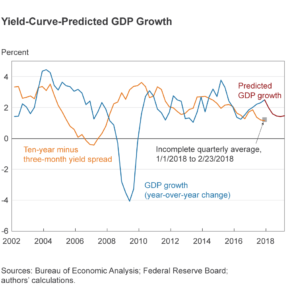

The Cleveland Federal Reserve maintains an interesting site that forecasts economic growth using the Treasury yield curve. They subtract the three-month treasury yield from the 10-year treasury yield, producing a fairly reliable predictor of GDP growth. You can see it in the chart below.

All that being said it is evident some of predictions from 2017 were a bit ahead of themselves.

The downward revisions also point to our stubbornly weak national economy compared to years past. The chart below shows the real domestic product on an annual basis. As you can see, growth since the Great Recession has remained weak.

There are a number of reasons for lower GDP growth. Fernando Martins of the Federal Reserve of St. Louis wrote a blog on this subject you can find here. To summarize his points, low productivity growth, excess capacity and demographics are all factors putting a lid on our growth rates.

These factors need to be weighed in not only for future government policy decisions, but for asset allocation decisions as well.