Over the summer, in both the financial press and in conferences I have attended, the dreaded R word, recession, has been the topic of discussion.

The second R word, rates, as in Federal Funds Rate and rate cuts, has closely followed, the thesis being that proactive rate cuts by the Federal Reserve have the potential to stall a decline in economic growth. Is this the case?

In order to answer that question, let us examine the last three recessions in the United States.

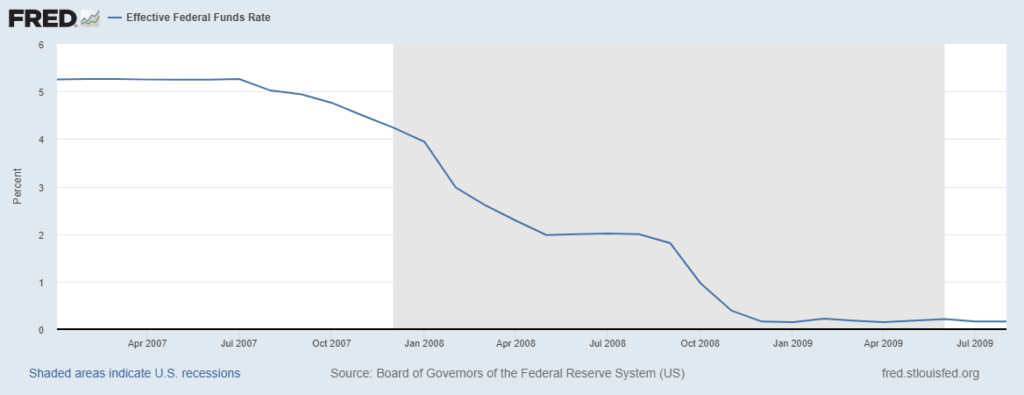

The most recent recession we have experienced, the Great Recession, was preceded by rate cuts.

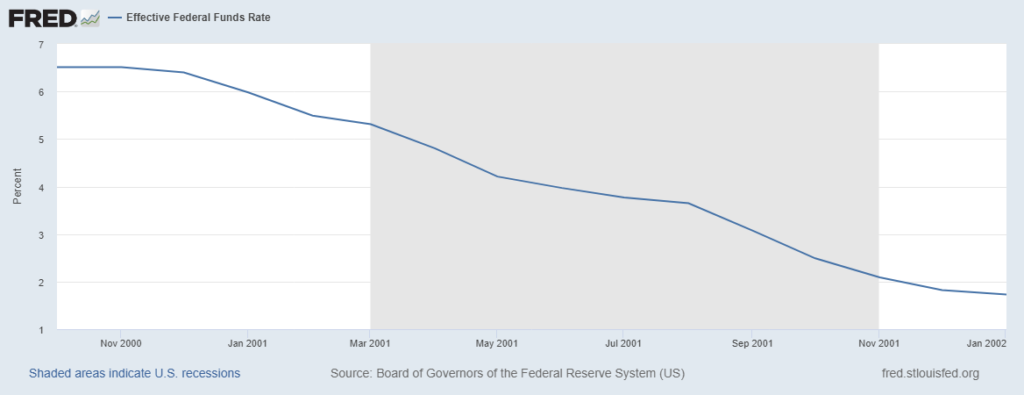

The prior recession, beginning in the spring of 2001, was preceded by rate cuts as well.

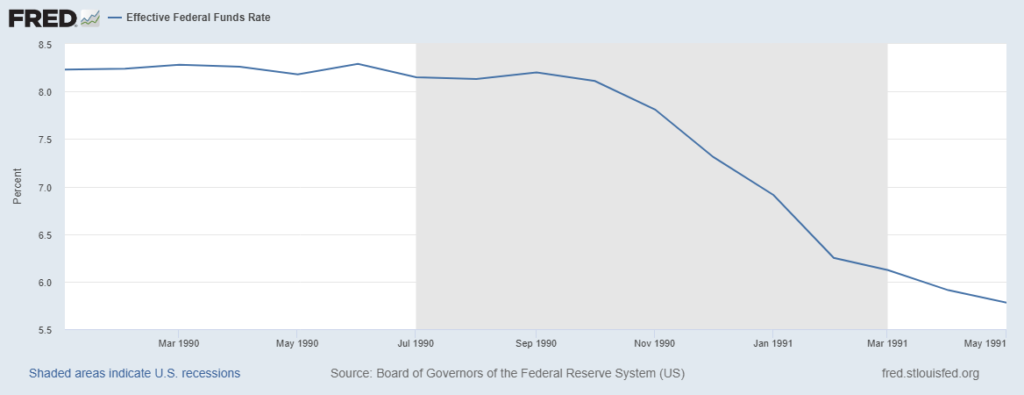

Finally, the very mild recession at the beginning of the ’90s also was preceded by a rate cut.

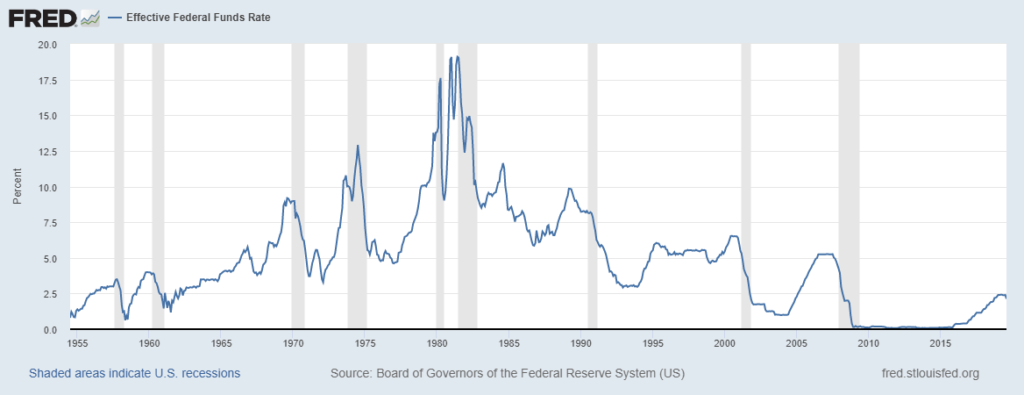

For the last thirty years, rate cuts have more often served as an indicator of an impending recession as opposed to an impediment.

In fact, you can see a pattern in rate cuts preceding recessions going back to 1954.

The National Bureau of Economic Research (NBER) serves as the authority which declares the dates the United States has entered into and exited an economic recession.

In the interest of precision, the NBER delays their announcements of entry and exit dates until data is confirmed. You can see this pattern in the chart below from NBER’s website.

| Turning Point Date | Peak or Trough | Announcement Date with Link |

| June 2009 | Trough | September 20, 2010 |

| December 2007 | Peak | December 1, 2008 |

| November 2001 | Trough | July 17, 2003 |

| March 2001 | Peak | November 26, 2001 |

| March 1991 | Trough | December 22, 1992 |

| July 1990 | Peak | April 25, 1991 |

| November 1982 | Trough | July 8, 1983 |

| July 1981 | Peak | January 6, 1982 |

| July 1980 | Trough | July 8, 1981 |

| January 1980 | Peak | June 3, 1980 |

For investors, this means that once we are sure our economy is in recession, it is usually too late to exit portfolio positions that are at risk. Your losses have already occurred.

The valuation of U.S. equities, currently at highs not seen since 1929, 1968 and 2000, are our only trustworthy guide as to the risk we are taking in our portfolios. In light of continual negative economic growth statistics, both domestically and abroad, as well as the triggering of well-known recession indicators such as yield-curve inversion, investors should use this window of time to review their portfolios for risks, which, at the current moment, are able to be evaded.