The service sector is what most Americans envision as the primary driver of the U.S. economy. Machinery, manufacturing, and heavy equipment, while still present, seem to be relics of a bygone time.

Statistically, this is not the case. The Gross Domestic Product of the U.S., or the amount the nation produces in a given year, is inordinately affected by the condition of the manufacturing sector. Furthermore, the change in the GDP of the manufacturing sector tends to be much more significant than the change we see in the GDP of the U.S. economy as a whole.

In the recession surrounding the Dot-Com bust, U.S. GDP only declined by 0.4%, while manufacturing GDP declined by 5%. During the Global Financial Crisis, U.S. GDP declined by 4%, while manufacturing GDP declined by 10%.

Understanding the ISM Manufacturing Index

Given the outsized role manufacturing plays in the economy, it is useful to understand whether it is growing or shrinking.

For this, we can turn to the ISM® Manufacturing PMI®, or Purchasing Managers’ Index. This metric is produced monthly by surveying more than 300 manufacturing firms across the U.S., and gives us insight into the health of the sector as a whole.

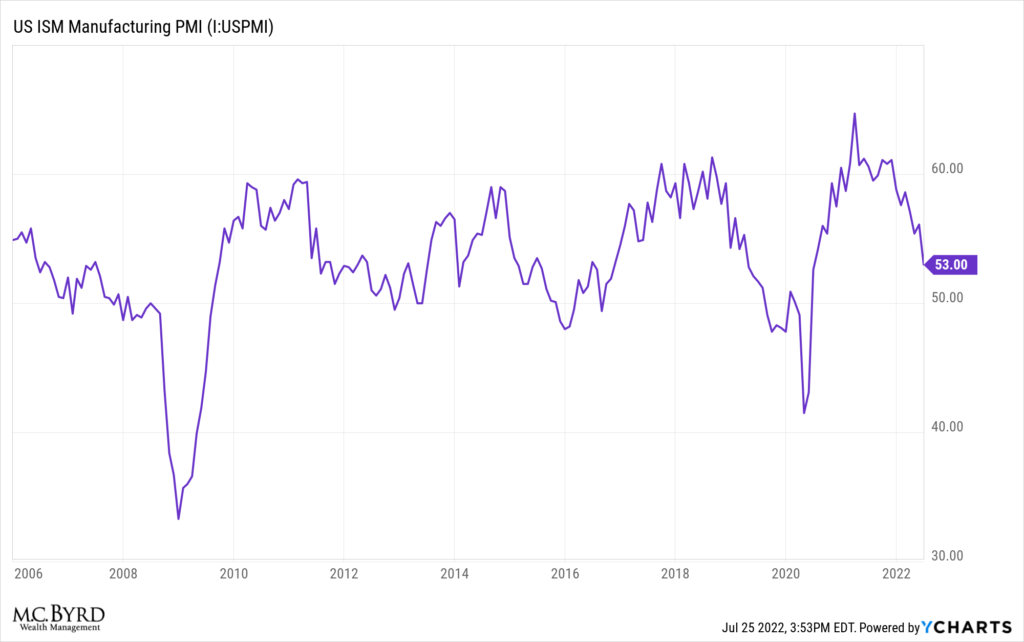

Above 50, the PMI indicates growth, at 50 indicates stasis and below 50 indicates contraction.

In June of 2022, this number sits at 53, indicating that manufacturing activity grew.

For the purposes of investors, the direction of the ISM® PMI® is more important than the absolute level it lies at in any given month. As you can see in the chart above, this number has declined rapidly since November of last year. Given this rapid decline, the bearish market activity we’ve experienced this year comes as no surprise.

The ISM index also has a significant impact on corporate decisionmakers given that it‘s based on a poll of executives in charge of their companies’ supply chains. If supply chains are the arteries of the U.S. economy these individuals are in the best position to take its pulse.

Thank you for reading our guide to understanding the ISM Manufacturing Index. To keep learning, we recommend reading some of our additional resources below or reaching out to the M.C. Byrd Wealth Management team for further discussion.