After the blistering August heat, the cool(er) winds of fall are always welcome.

This year the economy appears to be cooling off at the same time. Last week, we received the latest update to the Consumer Confidence Index. This Conference Board survey asks consumers key questions about their financial health.

Many surveys have lost their predictive ability due to political polarization. Because this survey asks about consumers’ personal situations, it remains an accurate guide to the economy.

The broad index dropped to 98.7 in September, down from 105.6 in August. However, key survey questions give us greater information about unemployment and corporate earnings. We’ll explore these questions below.

The Labor Differential & Unemployment

One of the questions survey participants are asked is whether jobs are hard to find or plentiful. The difference between these numbers gives us a forward look at unemployment. September’s number showed its worst decline in 6 months. Given these numbers, it would not be surprising to see the unemployment rate rise to 5.5% or 6% from its current 4.2%.

Chicago Fed Chair Austan Goolsbee has stated he would like to freeze unemployment at its current level. He says further deterioration would be detrimental to a soft landing. Given these numbers we would not be surprised to see more rate cuts ahead.

The Present Situation Index & S&P 500 Forward Earnings

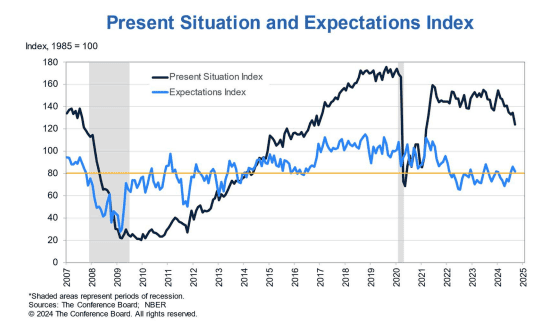

The Present Situation Index asks participants how they feel about their financial situation. This number, depicted by a dark blue line below, fell 10.3 points to 124.3. This exceeds the pace of declines observed at the onset of past recessions.

This data series’ annual growth correlates with S&P 500 forward earnings, which drives S&P 500 performance. We’ve already begun to see forward earnings estimates decline. This index tells us this trend might not be over.

Why these numbers matter:

Consumer sentiment is a key indicator of economic health and spending patterns. The drops we’re seeing are consistent with what we typically see at the onset of recessions. Given the triggering of the Sahm Rule this summer, it is not surprising the survey data is beginning to show a weaker economy.