What makes markets rise and fall? Earnings, sales growth and potential should be the fundamental reasons.

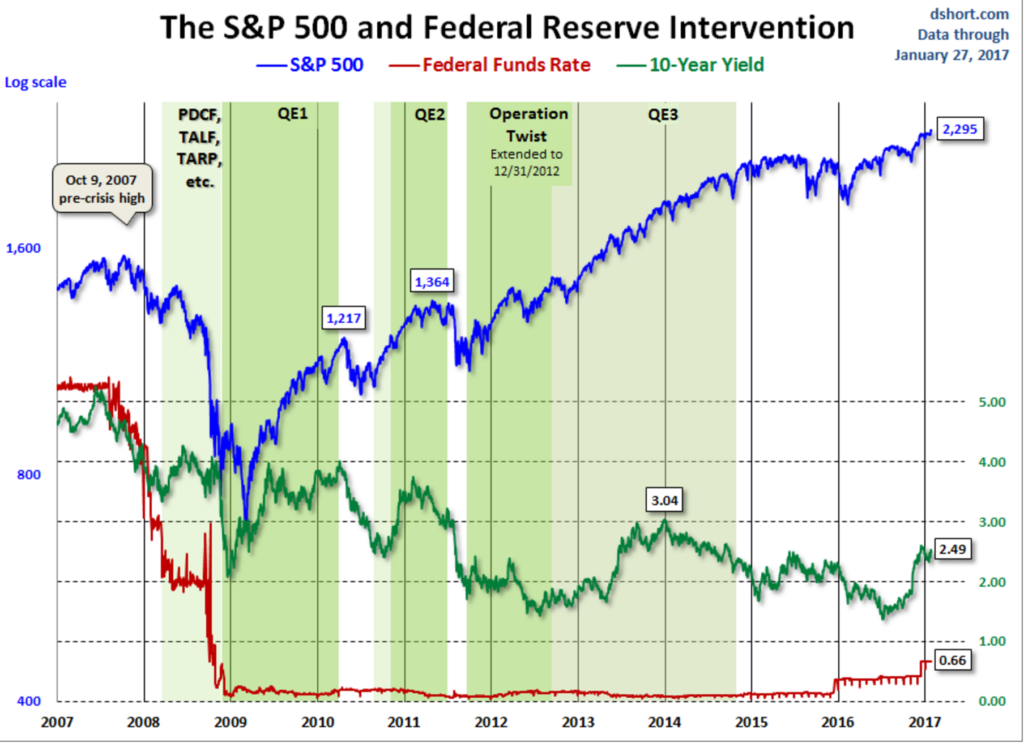

Dshort.com did a wonderful job in illustrating additional reasons for our current bull market run: our friends at the Federal Reserve.

As we take this walk down memory lane, let’s review some of the acronyms in the chart above.

PDCF – Primary Dealer Credit Facility

The New York Federal Reserve Bank defines it this way:

“The Primary Dealer Credit Facility (PDCF) was created in March 2008 as an overnight loan facility that provided funding to primary dealers in exchange for a specified range of eligible collateral. The PDCF was intended to foster the functioning of financial markets more generally. The facility expired on February 1, 2010.”

TALF- Term Asset-Backed Securities Loan Facility

“The Term Asset-Backed Securities Loan Facility (TALF) was a funding facility that helped market participants meet the credit needs of households and small businesses by supporting the issuance of asset-backed securities (ABS) collateralized by loans of various types to consumers and businesses of all sizes.

Under the TALF, the Federal Reserve Bank of New York (FRBNY) loaned up to $200 billion on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans.

The FRBNY extended loans in an amount equal to the market value of the ABS less a haircut and these loans were secured at all times by the ABS.

The U.S. Treasury Department– under the Troubled Assets Relief Program (TARP) of the Emergency Economic Stabilization Act of 2008– provided $20 billion of credit protection to the FRBNY in connection with the TALF.

The TALF began operation in March 2009 and was closed for new loan extensions on June 30, 2010. The final outstanding TALF loan was repaid in full in October 2014.”

– Board of Governors of the Federal Reserve System

TARP – Troubled Asset Relief Program

I am from East Texas. I could have a lot of fun with this. However, in this context, the acronym stands for the Troubled Asset Relief Program.

“Treasury established several programs under TARP to help stabilize the U.S. financial system, restart economic growth, and prevent avoidable foreclosures.

Although Congress initially authorized $700 billion for TARP in October 2008, that authority was reduced to $475 billion by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).

Of that, the following amounts were committed through TARP’s five program areas:

- Approximately $250 billion was committed in programs to stabilize banking institutions ($5 billion of which was ultimately cancelled).

- Approximately $27 billion was committed through programs to restart credit markets.

- Approximately $82 billion was committed to stabilize the U.S. auto industry ($2 billion of which was ultimately cancelled).

- Approximately $70 billion was committed to stabilize American International Group (AIG) ($2 billion of which was ultimately cancelled).

- Approximately $46 billion was committed for programs to help struggling families avoid foreclosure, with these expenditures being made over time.”

– U.S. Department of the Treasury

“Quantitative Easing 1 – The Federal Reserve increased its balance sheet by from $800 billion to 2.054 trillion in bank debt, mortgage back securities and treasury notes.

Quantitative Easing 2 – The Federal Reserve purchased $600 billion of Treasury securities.

Quantitative Easing 3 – The Federal Reserve began a $40 billion dollar per month bond purchasing program of mortgage-backed securities.”

“Operation Twist, or ‘Twist’, is a policy by which the Federal Reserve sells short-term government bonds and buys long-dated Treasuries, in an effort to push down long-term interest rates and therefore boost the economy.”

Conclusion

What is my point in this walk down memory lane?

As you can see in the chart, government intervention in our markets started in 2008 and it is not over.

The red line in the chart is the federal funds rate. The federal funds rate affects interest rates, mortgages, currency. The list goes on. It is still below normal. The Federal Reserve is still intervening in our markets.

My point is that this is not a normal market where market forces act as the primary driver of asset prices.

The Federal Reserve wants normalization. You can read their comments here:

https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm.

Can we unwind years of intervention without volatility?

Only time will tell, but I would venture to say the answer is no.